Property Investing and SMSF’s – The Differences

Property Investing and SMSF’s – The Differences

There are many rules governing borrowing within SMSFs to purchase property. This article briefly explains what types of property can be purchased within super with a particular explanation about the rules governing purchase of house and land packages. It recommends seeking guidance from licensed professionals.

Australians love to invest in property. And what’s not to love? It’s tangible, offers diversification and tax benefits, and can provide you with a good income and strong capital growth.

The benefits of investing in property can be amplified when held within super and with changes to borrowing within Self-Managed Super Funds (SMSFs) over the past few years, the ability to access property investment through super has widened significantly. This strategy however, is not for everyone.

Investing in property within a SMSF is not a straightforward proposition. It is a highly regulated affair and having an understanding of the rules is essential to ensure your fund remains compliant and you don’t get caught out in a compromising and costly position.

What type of property can be purchased within a SMSF?

You can purchase all kinds of property within your SMSF –commercial, industrial or residential. But there are different regulatory requirements for each.

Residential Property

Any residential property you wish to purchase through your SMSF must:

- meet the ‘sole purpose test’ – this essentially means the fund must be run for the sole purpose of providing retirement benefits to its members;

- not be attained from a related party to the member such as a spouse, family member or business partner;

- not be rented or lived in by a member or party related to the member.

Commercial or Industrial Property (Business Real Property)

Similar to investing in residential property, any commercial or industrial property investment must also meet the sole purpose test. Except that you can rent or purchase commercial or industrial property (business real property) from your SMSF – provided it’s at market rates.

When a SMSF can borrow

In the event that you have insufficient capital within your SMSF to purchase the property outright, your Fund can borrow to purchase property through the use of a limited recourse borrowing arrangement.

Be aware that borrowing arrangements through super can be very restrictive. There are rules around acquiring property using borrowings. For example, although a SMSF can purchase a vacant block of land, it cannot purchase a block of land with the view of constructing a house on the block using borrowings. This would breach the ‘single acquirable asset rule’.

Under this rule, a house and land package would not be treated as a single acquirable asset unless there are only two payments involved, e.g. a 30% deposit and a 70% payment of the balance when the house is complete.

You should be cautious when it comes to investing in property through your SMSF. There are many property “specialists” who have a vested interest in selling these kinds of investments to SMSF members. They are likely to receive some sort of a commission and may push property purchases through super without having an accurate understanding of a member’s situation.

Investing in property through super is not advisable for everyone. Before signing any type of contract always seek advice from a licensed financial planner or authorised SMSF specialist.

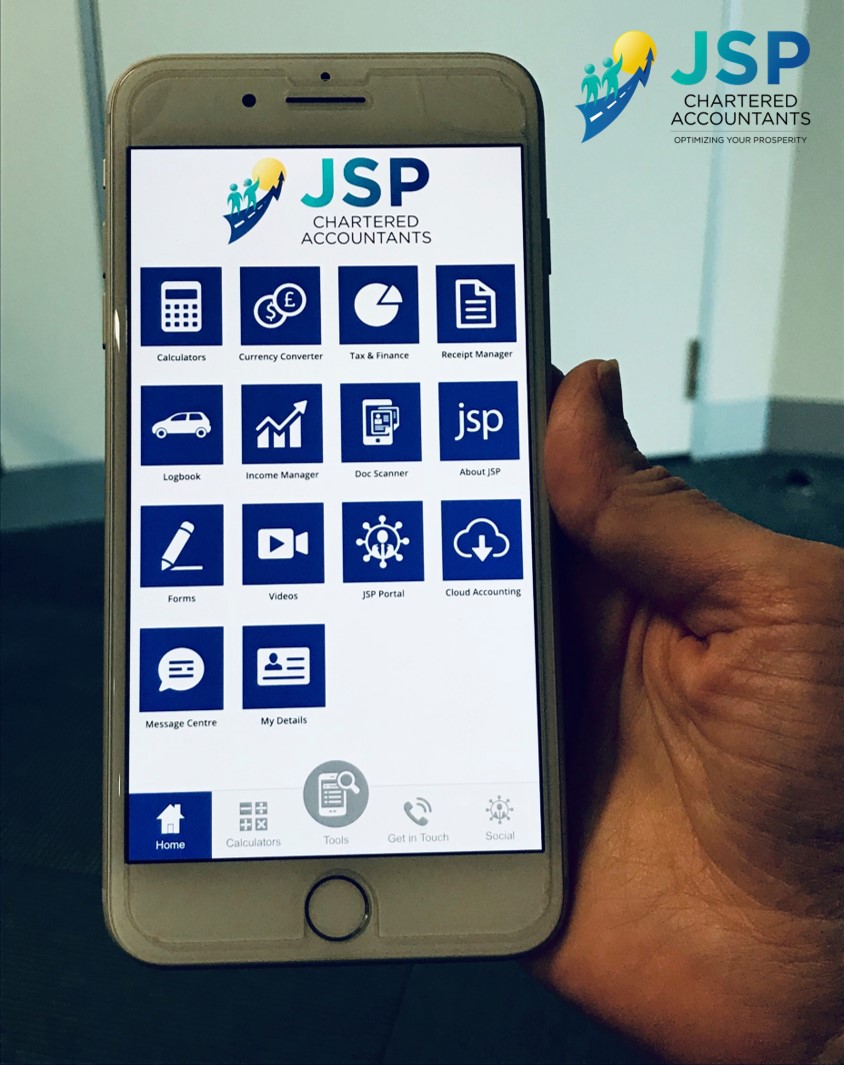

Ron Malhotra – Wealth Planner, JSP Partners

Sources:

- a) Not for publication

ATO website: www.ato.gov.au – Super – Self-managed-super-funds – Limited recourse borrowing arrangements by self managed super funds – questions and answers

Sydney Business Lawyers – www.sydneybl.com.au Marketing Newsletter Super LRBA1 ‘Limited Recourse Borrowing Arrangements – Gearing of SMSFs’

- b) For publication

Australian Taxation Office www.ato.gov.au Super – Self-managed Super Funds