Cash Flow Benefits of Online Accounting

Cash Flow Benefits of Online Accounting

Compared to late 2011, Xero users worldwide are now getting paid more than two weeks faster on average. In October 2011, Xero users were getting paid after an average of 48 days, and now they’re getting paid in an average of 33 days – a 15 day difference.

As ready access to cash is such a key part of every small business’s success or failure, this 15 day difference is very beneficial. If you have cash, you pay your bills and the lights stay on. If you don’t have cash, you can’t pay your bills and the lights go out. No matter how many outstanding invoices you have out in the field, it’s the cash in the bank that actually fuels your business.

How do we get paid even faster?

Xero aren’t satisfied with 33 days – and you shouldn’t be either. The lower this number, the healthier your business will be.

Here are a few ways you can use Xero to get paid faster and turn more invoices into cold, hard cash:

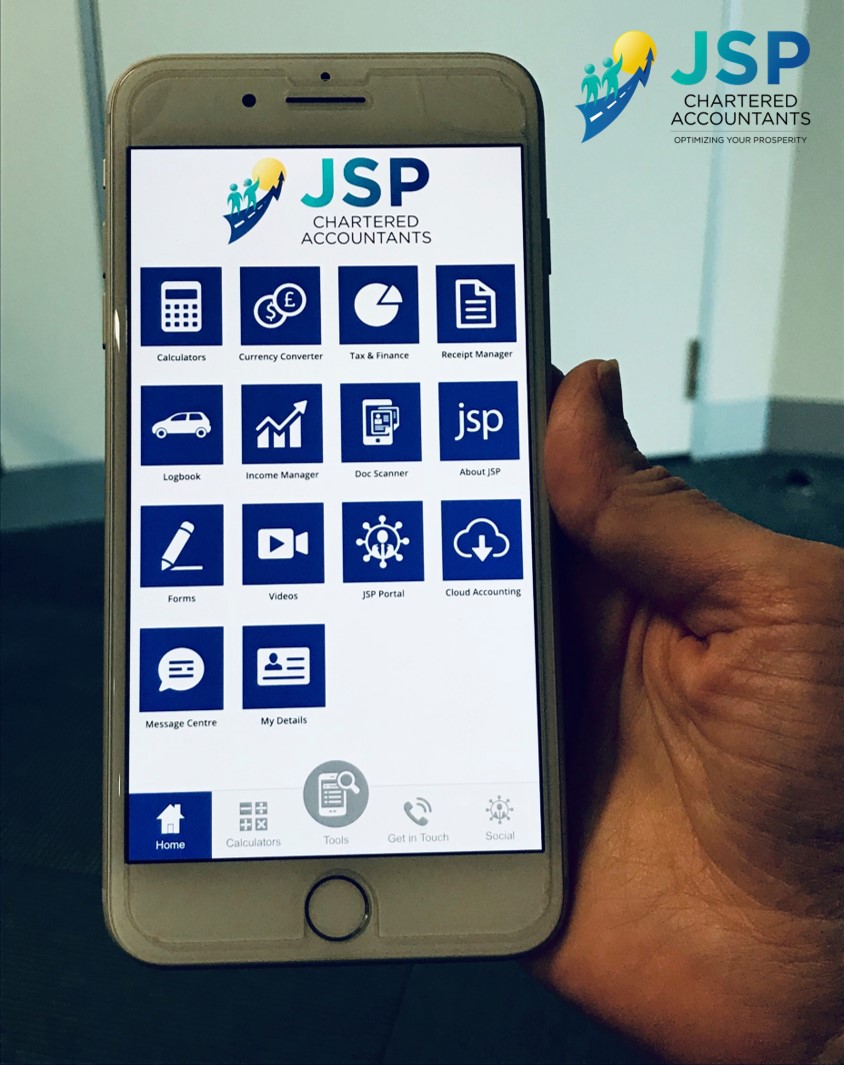

- Through using immediate invoicing with Xero’s mobile accounting app, you are able to enjoy the freedom to send or approve invoices without being tied to your desk

- Online invoicing can help you get paid faster by cutting time out of the actual invoicing process, as the invoice is sent electronically direct to the customer, who can pay instantly through a ‘pay now’ button on the invoice

- Use the aged receivables report to chase any late invoices and to see who has the biggest or oldest outstanding invoice, allowing you to make a few targeted phone calls which should have a much higher impact on your cash flow

As accountants, we can assist in spotting all kinds of problems that you may not notice. Or, even better, we can spot small problems that you can quickly solve before they develop into major cash flow bottlenecks in future. More often than not, this is a worthwhile investment.